| Product | Best For | Cost Per Month | Standout Features | Popular Integrations |

|---|---|---|---|---|

|

$35 – $235

|

Familiar interface

Extensive integrations

|

Salesforce

Bill.com

|

|

|

|

$20 – 80$

|

Bank feed automation

Modern interface

|

Stripe

PayPal

|

|

|

$79 – $229

|

Built for nonprofits

Integrated donor management

|

Stripe

Mailchimp

|

|

|

Upon request

|

Multi-dimensional fund accounting

Powerful reporting

|

Salesforce

Raiser’s Edge

|

|

|

Upon request

|

Raiser’s Edge NXT integration

Sophisticated fund accounting

|

Raiser’s Edge NXT

Blackbaud Merchant Services

|

|

|

Upon request

|

Grant management

Budget monitoring

|

Various CRM systems

Banking institutions

|

|

|

Upon request

|

Multi-dimensional accounting

Real-time dashboards

|

Salesforce

Bill.com

|

|

|

Upon request

|

Microsoft Dynamics integration

Multi-currency support

|

Microsoft Dynamics 365

Microsoft 365

|

|

|

Upon request

|

User-friendly interface

Affordable pricing

|

PayPal

Stripe

|

Small to medium-sized nonprofits needing standard accounting with basic nonprofit functionality; organizations transitioning from manual methods or simpler software.

~$35 – $235 (This is the discounted pricing for non-profits)

Pros

- User-friendly and widely understood interface.

- Extensive range of third-party app integrations.

- Relatively affordable, especially with nonprofit discounts.

Cons

- Lacks true multi-dimensional fund accounting required for complex reporting.

- Nonprofit reporting requires extensive use of classes/locations and custom reports.

- Scaling complexity (many grants, restricted funds) can become cumbersome.

Pricing Plans

Simple Start

~$35/monthEssentials

$65/monthPlus

$99/monthAdvanced

$235/monthIntuit offers significant discounts (often 50% or more) for eligible nonprofits. Pricing shown is standard retail.

- Bill.com

- DonorPerfect

- Neon CRM

- Salesforce

- PayPal

- Stripe

- Gusto

- Expensify

A very popular choice due to its ubiquity and ease of use. While not purpose-built for fund accounting, its class/location features can be configured to manage basic fund tracking. It’s an excellent starting point for many smaller nonprofits, but larger or more complex organizations may outgrow its nonprofit-specific capabilities.

It is the most widely used accounting software globally and a very common entry point for nonprofits due to its familiarity, accessibility, and integration capabilities, despite not being solely nonprofit-focused.

- Accounts Payable/Receivable

- Chart of Accounts

- Bank Reconciliation

- Budgeting

- Reporting (Profit & Loss by Class/Location, Statement of Activities – requires setup)

- Donor/Grant tracking (via classes/locations)

- Bill Management

- Invoice Management

- Inventory (less relevant for most NPOs)

- Payroll Integration

- CRM Systems (Salesforce, Neon CRM, DonorPerfect)

- Payment Processors (Stripe, PayPal)

- Payroll Services (Gusto, QuickBooks Payroll)

- Bill Pay (Bill.com)

- Expense Management (Expensify)

- Budgeting & Reporting tools

High. Most bookkeepers and accountants are familiar with QuickBooks. The online interface is intuitive.

Small to medium-sized nonprofits who prefer a clean, modern interface; organizations with strong online banking integration needs.

$20 – $80 (Standard Xero Pricing, inquire about nonprofit discounts)

Pros

- Modern, clean, and user-friendly interface.

- Excellent bank feed connections and reconciliation.

- Good value for small to medium organizations.

Cons

- Lacks native, robust fund accounting capabilities.

- Tracking categories can be limiting for complex reporting needs.

- Less market share and fewer third-party integrations compared to QBO in the US nonprofit space.

Pricing Plans

Early

$20/monthGrowing

$47/monthEstablished

$80/monthXero often offers nonprofit discounts. Pricing shown is standard retail.

- Bill.com

- Stripe

- PayPal

- Gusto

- Pipedrive

- Vend

- Expensify

Xero is a strong competitor to QBO with a sleek interface and robust core accounting. Like QBO, it uses tracking categories instead of true fund accounting, making it suitable for nonprofits with less complex funding structures. Its bank feed reliability is often cited as a strength.

A popular cloud accounting alternative to QBO, favored for its modern design and bank automation, suitable for nonprofits seeking a user-friendly general accounting system.

- Accounts Payable/Receivable

- Bank Reconciliation (automated feeds)

- Budgeting

- Reporting (Profit & Loss by Tracking Category)

- Fixed Assets

- Expense Claims

- Inventory (basic)

- Multi-currency

- Payment Processors (Stripe, PayPal)

- Payroll (Gusto, external apps)

- CRM (less direct nonprofit focus than QBO integrations)

- Bill Pay (Bill.com)

- Expense Management (Expensify)

High. The interface is intuitive and well-designed.

Aplos

Small to medium-sized churches and nonprofits specifically seeking integrated fund accounting, donor management, and contribution tracking.

$79 – $229 (Depends on modules and contacts)

Pros

- Purpose-built for nonprofits with native fund accounting.

- Integrated donor management and contribution tracking.

- Designed to simplify nonprofit reporting (SoAP, SoFP, Functional Expenses).

Cons

- Less flexibility and fewer integrations compared to general software like QBO/Xero.

- Can feel less powerful in core accounting features compared to dedicated solutions.

- Reporting, while nonprofit-focused, can sometimes be less customizable than higher-end systems.

Pricing Plans

Aplos Lite

$79/monthAplos Core

~$99/monthAplos Advanced

$229/monthPricing varies based on modules and database size.

- Stripe

- PayPal

- QuickBooks

- Mailchimp

- Vanco

- Kindful

- GuideStar

Aplos is a strong contender for smaller to mid-sized nonprofits and churches that want an all-in-one solution specifically designed for their needs. Its integrated fund accounting and donor features simplify compliance and reporting significantly compared to using separate systems or workarounds in general software.

A leading example of software specifically designed for the nonprofit and church sector, offering integrated fund accounting and donor management for smaller organizations.

- Fund Accounting

- Chart of Accounts (by fund)

- Contribution Tracking

- Donor Management

- Batch Entry

- Budgeting

- Accounts Payable/Receivable

- Bank Reconciliation

- Fixed Assets

- Payroll Integration (via partner)

- Reporting (SoAP, SoFP, Budget vs Actuals, Functional Expenses)

- Payment Processors (Stripe, PayPal, Vanco)

- CRM/Donor (Kindful – although Aplos has its own)

- Email Marketing (Mailchimp)

- QuickBooks (for historical data migration)

- GuideStar

Moderate to High. The interface is straightforward and designed for nonprofit workflows, but may take some learning if users are only familiar with general accounting software.

Medium to large nonprofits requiring robust, detailed fund accounting, grant management, and complex reporting across multiple dimensions.

Upon request (Cloud hosting, custom pricing)

Pros

- Exceptional, true multi-dimensional fund accounting.

- Powerful and flexible reporting capabilities.

- Robust audit trail and internal controls.

Cons

- Higher cost of entry and ongoing fees.

- Steeper learning curve and requires trained staff.

- Interface can feel dated compared to newer cloud-native software (though cloud version improves this).

Pricing Plans

Core Financials

Custom pricingBase module

Payroll Module

Custom pricingAdd-on module

HR Management

Custom pricingAdd-on module

AP/AR Modules

Custom pricingAdd-on modules

Additional Modules

Custom pricingFixed Assets, Allocations, Grants, Budgeting

Pricing varies based on modules, users, hosting option, and database size.

- Salesforce

- Raiser’s Edge (Blackbaud)

- Various payroll providers

- Online donation platforms

- Budgeting software

MIP is a long-standing leader in nonprofit fund accounting, trusted by thousands of organizations. It provides the depth and flexibility needed for complex financial structures, detailed grant reporting, and audit readiness. It’s more expensive and requires more specialized knowledge than general accounting software.

A long-established and widely recognized leader in providing robust fund accounting software specifically for nonprofits, suitable for organizations with complex financial reporting needs.

- Multi-dimensional Chart of Accounts (Funds, Programs, Grants, Departments, etc.)

- Accounts Payable/Receivable

- General Ledger

- Budgeting

- Encumbrance Accounting

- Fixed Assets

- Payroll (module)

- Human Resources (module)

- Grant Management (module)

- Allocations

- Reporting (SoAP, SoFP, Functional Expenses, Grant Reports, Budget vs Actuals)

- Audit Trail

- CRM Systems (Salesforce, Raiser’s Edge via third parties)

- Payroll services (ADP, Paychex)

- Budgeting & Planning tools

- Online Donation platforms

- CRM Systems (Salesforce, Raiser’s Edge via third parties)

- Payroll services (ADP, Paychex)

- Budgeting & Planning tools

- Online Donation platforms

Moderate to Low (initially). The system is powerful but complex. It requires dedicated training and understanding of fund accounting principles. Day-to-day tasks become easier with practice.

Large nonprofits, foundations, and institutions already within the Blackbaud ecosystem, requiring advanced fund accounting, grant management, and robust reporting integrated with fundraising/CRM.

Upon request (Cloud-based, custom pricing)

Pros

- Seamless, native integration with Blackbaud’s leading fundraising CRM (Raiser’s Edge NXT).

- Robust fund accounting and grant management capabilities.

- Comprehensive reporting designed for large nonprofits.

Cons

- One of the most expensive options.

- Requires significant training and specialized staff.

- Can be overly complex for mid-sized organizations or those not using other Blackbaud products.

Pricing Plans

Core Financials

Custom pricingBase financial management

Grant Management

Additional moduleTrack and manage grants

Fixed Assets

Additional moduleTrack and manage organization assets

Budgeting

Additional moduleAdvanced budgeting capabilities

Pricing is highly customized based on modules, users, transaction volume, and other Blackbaud products used. Contact Sales for a custom quote.

- Raiser’s Edge NXT (native)

- Blackbaud Merchant Services

- Various payroll providers

- Budgeting tools

- Omatic Software (integration middleware)

Financial Edge NXT is a top-tier accounting solution for large nonprofits, particularly those heavily invested in the Blackbaud fundraising platform. Its strength lies in its seamless integration with Raiser’s Edge NXT and its comprehensive feature set for managing complex nonprofit finances and reporting. It’s a significant investment in both cost and implementation.

A leading financial management solution for large nonprofits and foundations, deeply integrated with the most widely used nonprofit CRM (Blackbaud’s Raiser’s Edge), offering enterprise-level fund accounting.

- Fund Accounting

- Multi-dimensional Chart of Accounts

- Accounts Payable/Receivable

- General Ledger

- Grant Management

- Project Accounting

- Fixed Assets

- Budgeting

- Allocations

- Encumbrance Accounting

- Comprehensive Reporting (SoAP, SoFP, Functional Expenses, Grant Reports, Dashboards)

- Audit Trail

- Bank Reconciliation

- Blackbaud Raiser’s Edge NXT (native)

- Blackbaud Merchant Services (payments)

- Omatic Software (middleware for various integrations)

- Payroll providers.

Moderate (for daily tasks) to Low (for initial setup and complex reporting). The cloud interface is modern, but the underlying functionality is sophisticated and requires expertise.

Nonprofits and government entities needing strong fund accounting, grant management, and budget control, suitable for mid-sized to large organizations.

Upon request (Cloud hosting, custom pricing)

Pros

- Purpose-built for nonprofit and government fund accounting.

- Excellent grant management and budgeting features.

- Flexible reporting meets diverse funder and regulatory needs.

Cons

- Interface can feel less modern than some cloud-native competitors.

- Requires professional implementation and training.

- Integration options may be less extensive than market leaders in general accounting.

Pricing Plans

Core System

Custom pricingGL, AP, AR, Cash Receipts

Specific Modules

Custom pricingGrant Management, Budget Reporting, Payroll, Fixed Assets

Add-on Modules

Custom pricingClient Accounting, Loan Management, Utility Billing

Cloud Hosting

~$400 – $1,500+/monthBased on modules, users, and database size

Contact Sales for a custom quote based on your organization’s needs.

- Various CRM systems

- Payroll providers

- Banking institutions

- Budgeting tools

- Payment processors

AccuFund is a solid, reliable financial management system specifically designed for the public sector, including nonprofits. It excels in areas like grant management, budgeting, and providing the detailed audit trails and reporting required by funders and regulators. It offers a good balance of features for complex organizations without the scale (or cost) of potentially larger ERP systems.

A dedicated fund accounting solution for nonprofits and government entities, known for its strength in grant management and budgeting, serving the needs of mid-sized to large organizations.

- Fund Accounting

- Accounts Payable/Receivable

- General Ledger

- Grant Management

- Budgeting

- Encumbrance Accounting

- Fixed Assets

- Payroll (module)

- Allocations

- Cash Receipts

- Reporting (SoAP, SoFP, Functional Expenses, Grant Reports, Budget Performance)

- Audit Trail

- Bank Reconciliation

- CRM Systems (via APIs or custom integration)

- Payroll providers

- Banking institutions

- Third-party reporting tools

Moderate. The interface is functional but less intuitive than general accounting software. Requires training to leverage its full power, especially in reporting and module-specific tasks.

Growing or large nonprofits needing a highly flexible, cloud-native financial management system with strong fund accounting, reporting, and dimension tracking.

Upon request (Cloud-native, custom pricing)

Pros

- True multi-dimensional accounting provides unparalleled reporting flexibility.

- Cloud-native platform with strong automation and real-time dashboards.

- Highly scalable and configurable for growing organizations.

Cons

- Higher cost compared to small-business or entry-level nonprofit software.

- Requires professional implementation and training to fully utilize its power.

- Complexity might be overkill for very small or simple organizations.

Pricing Plans

Core Financials

Custom pricingBase financial modules

Nonprofit Module

Additional costFund accounting, grants, etc.

Additional Modules

VariesSpend Management, Project Accounting, Fixed Assets

User-based Pricing

Per userStandard and occasional user options

Pricing is highly customized based on modules, dimensions, and users.

- Salesforce

- Bill.com

- Expensify

- Avalara

- Various payroll solutions

- Budgeting solutions

- Third-party marketplaces

Sage Intacct is a leading cloud financial management system with a dedicated, powerful nonprofit edition. Its multi-dimensional architecture is incredibly flexible for tracking by fund, grant, program, location, etc., and slicing data for sophisticated reporting and real-time dashboards. It’s scalable and integrates well, making it ideal for complex or fast-growing nonprofits.

A top-tier, cloud-native financial management system with a powerful nonprofit edition recognized for its multi-dimensional accounting and real-time reporting, suitable for growing and complex organizations.

- Multi-dimensional Accounting

- Accounts Payable/Receivable

- General Ledger

- Grant Tracking

- Budgeting

- Allocations

- Spend Management

- Fixed Assets

- Cash Management

- Custom Dashboards

- Automated Workflows

- Multi-entity support

- Salesforce (deep native integration)

- Bill.com

- Expensify

- Payroll providers

- Budgeting/Planning tools

- Payment Processors

- Extensive Marketplace of third-party apps

Moderate (for daily tasks) to Low (for initial setup and complex reporting). The interface is modern and logical once configured, but the power under the hood requires understanding the dimensional structure and reporting engine.

Mid-sized to large nonprofits, public sector entities, and international NGOs already using or considering the Microsoft Dynamics 365 ecosystem, needing a robust, integrated ERP-like financial system.

Upon request (Custom pricing based on Dynamics 365)

Pros

- Built on the robust and widely-supported Microsoft Dynamics 365 platform.

- Strong capabilities for multi-currency, multi-language, and international operations.

- Offers a foundation for a broader integrated ERP ecosystem.

Cons

- Requires Dynamics 365 expertise for implementation and administration.

- Higher cost and complexity, typical of ERP systems.

- User interface, while part of D365, may still require significant training.

Pricing Plans

Dynamics 365 Licensing

Essential or PremiumBase platform licensing

Serenic Navigator Modules

Additional costFund Accounting, Grants, Budgeting

User Licensing

Per userDifferent access levels available

Implementation Services

Custom quoteCustomizations and implementation

Contact Sales for a custom quote based on your organization’s needs.

- Microsoft Dynamics 365 Sales/CRM

- Microsoft 365 (Office, Power BI)

- Various third-party apps within the Dynamics ecosystem

Serenic Navigator leverages the power and familiarity of the Microsoft Dynamics platform to provide a comprehensive financial management solution for nonprofits and public sector organizations. It’s particularly strong for organizations needing multi-currency, multi-language, or wanting a foundation for a broader ERP system alongside CRM and other business processes. It’s a significant enterprise-level investment.

Provides a robust, ERP-capable fund accounting solution built on the Microsoft Dynamics 365 platform, suitable for larger, complex, and potentially international nonprofits already in or considering the Microsoft ecosystem.

- Fund Accounting

- Accounts Payable/Receivable

- General Ledger

- Grant Management

- Project Accounting

- Budgeting

- Allocations

- Fixed Assets

- Encumbrance Accounting

- Multi-currency

- Multi-language

- Custom Reporting

- Audit Trail

- Microsoft Dynamics 365 Sales/CRM (native)

- Microsoft 365 (Excel, Word, Power BI)

- Various third-party solutions compatible with Dynamics 365 Business Central

Moderate to Low (initially). While based on Dynamics 365, the specific nonprofit modules add layers of functionality that require training. Day-to-day use is standard for an ERP once learned.

Small to medium-sized nonprofits needing dedicated, easy-to-use fund accounting software without the complexity or cost of larger systems.

Upon request (Cloud hosting or on-premise)

Pros

- Dedicated fund accounting software for nonprofits.

- More affordable and potentially easier to implement than enterprise systems.

- Modular design allows organizations to add functionality as needed.

Cons

- Interface can feel less modern compared to cloud-native options.

- Fewer integrations and a smaller ecosystem than QBO or Xero.

- Less scalable for very large or highly complex multi-entity organizations compared to top-tier ERPs.

Pricing Plans

Core Accounting

Contact SalesGL, AP, AR, Bank Rec

Grant Management

Module Add-onTrack grants and reporting

Allocations

Module Add-onFor functional expense allocation

Fixed Assets

Module Add-onAsset tracking and depreciation

Pricing varies based on modules, users, and cloud vs. on-premise deployment.

- Payroll services (ADP, Paychex)

- CRM/donor management systems

- Online donation platforms

Fund E-Z provides solid fund accounting capabilities in a package that is more accessible and less expensive than the enterprise-level systems (MIP, Blackbaud, Sage Intacct). It’s a good fit for nonprofits who have outgrown QBO/Xero’s class-based system but don’t need the full power and cost of larger solutions. It focuses purely on the financial side.

A solid, dedicated fund accounting software option specifically for nonprofits, offering a balance of necessary features and relative affordability for small to mid-sized organizations.

- Payroll providers (ADP, Paychex)

- some CRM/Donor Management systems (via import/export or specific connectors)

- Online Donation Platforms.

Moderate. Designed with nonprofit workflows in mind, making core tasks intuitive once trained. Reporting setup might require more effort. Generally considered easier to learn than MIP or AccuFund.

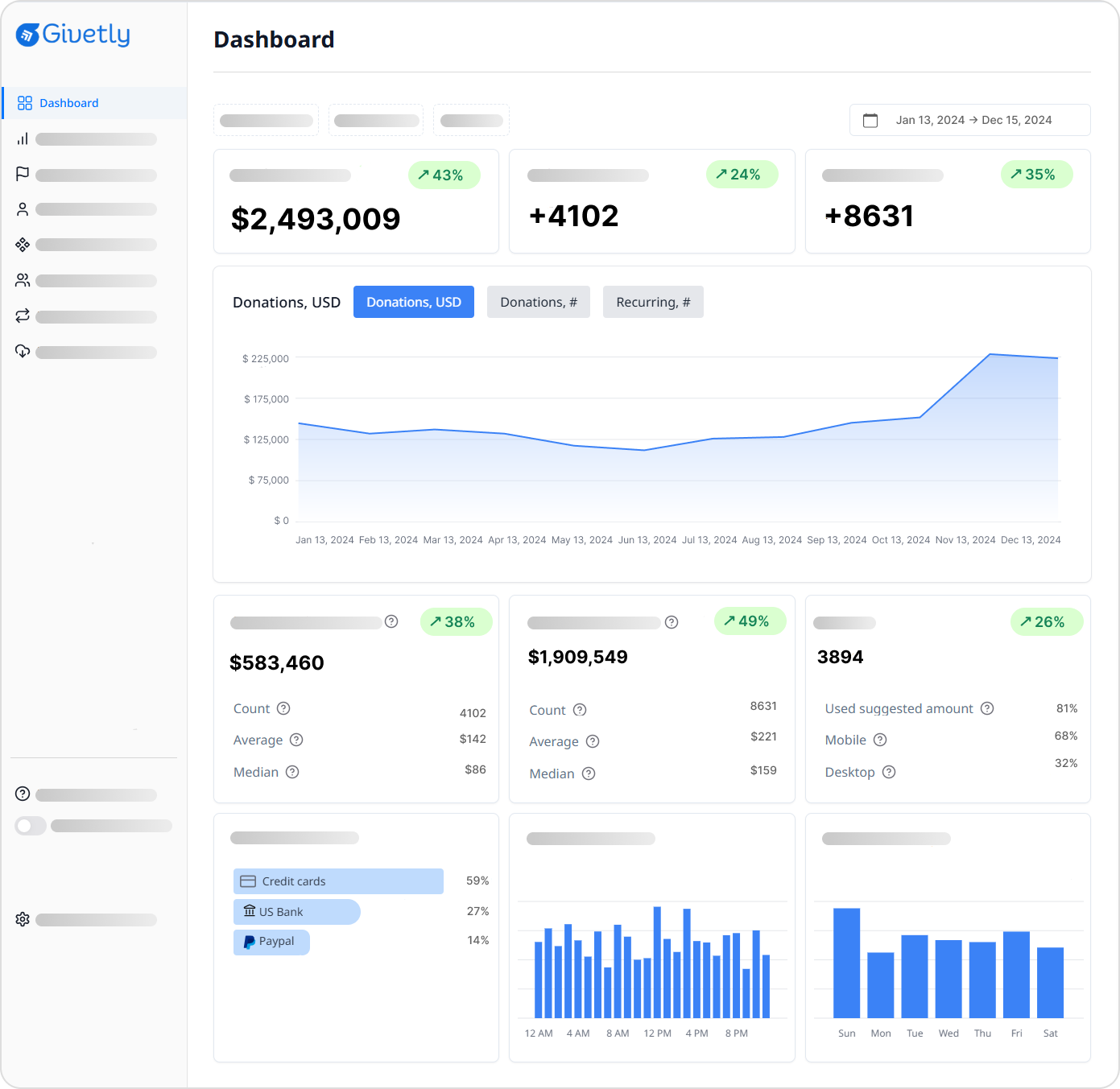

Simplify Fundraising and Empower Your Mission

Givetly provides seamless payment solutions designed specifically for non-profits. Increase donations, reduce processing fees, and focus on what matters most – your cause.